Gary Gleeson

(Principal | MFM Group)

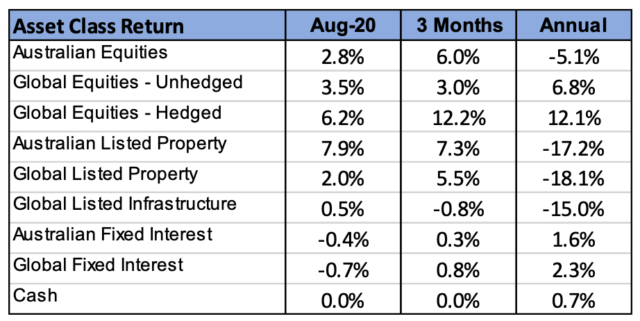

- Australian Listed Property was a standout asset class in August, driven by better than expected results and hints of a recovery in residential property. However, the sector has under-performed the broader market since February.

- Global Equities were also strong, but this was largely driven by the US market where the large technology names continued to dominate returns. Non-US equity markets remain in the red for the past twelve months, highlighting the disproportionate impact of the FAANGs (Facebook, Apple, Amazon, Netflix, Google).

- Bond interest rates rose in Australia and elsewhere, which meant bond prices fell and fixed interest markets produced negative returns for the month.

- The A$ rose against the US$, finishing up 2.0% at US$0.735, which dampened unhedged returns from global equities.

- Commodity prices were generally higher this month, particularly Iron Ore which rose 12.3%.

International Equities

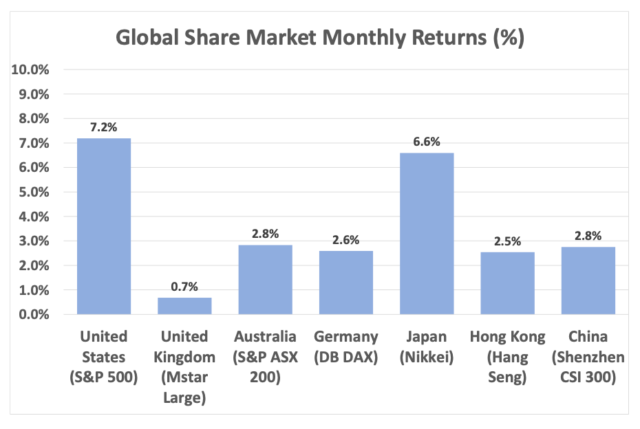

Equity markets rose this month, supported by comments from the US Federal Reserve and company earnings reports, which were marginally better than expected overall despite considerable dispersion between sectors and companies. Correlation of returns between markets has declined further, suggesting that returns are being driven by differing local and company specific responses to the global issues posed by the pandemic. A broad underlying positive influence last month was the announcement by the US Fed of a change to their inflation target structure which allows higher levels of short-term monetary stimulus when necessary to maintain economic activity. The exceptional performance of the US market has moderated early in September but the forces driving prices are unchanged – increased money supply from central banks, fiscal stimulus by governments and strong growth outlooks for technology companies and those operating on-line businesses. The coming US election and other geo-political events are starting to provide distractions, but it remains to be seen whether these distractions will have long lasting effects on market direction.

Outside of the US, Asian markets were also strong last month with China’s economic performance continuing to be supportive of both equity markets and commodity prices.

Australian Equities

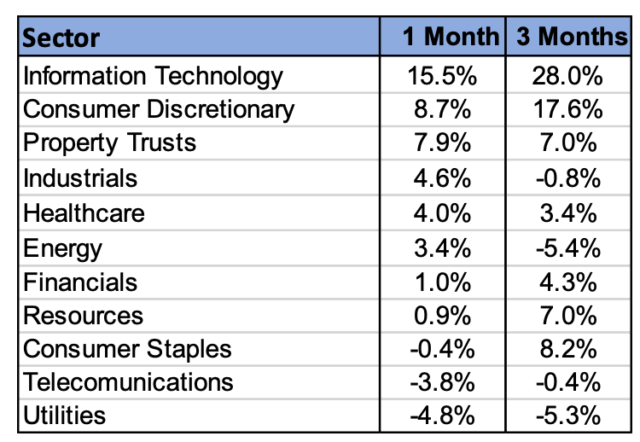

The Australian market reported a rise of 2.8% in August – a relatively good performance for a profit reporting season. Despite this, company profits overall were disappointing relative to expectations and of course down significantly on the previous period. Overall, though, the Australian market performance fell further behind global markets. This is partly due to market composition with the ASX dominated by Financials and Miners rather than the growing Technology sector. Small companies out-performed again driven by strong Information Technology share prices (up 15.5%). Consumer Discretionary companies delivered some very good and very poor results, with wins concentrated in necessities and goods provided or related to on-line activities. Stockland’s (up 24%) note of improved activity in residential property sales in June and July drove the Property Trust sector while Consumer Staples, Telecommunications and Utilities were held back by poor results and outlooks. A clear theme in reports was continued uncertainty regarding the impact of COVID. There was also a clear difference between companies prepared to operate on-line and those either unable or unprepared to move business activities to an on-line environment.

Fixed Interest & Currencies

After the US Fed’s announcement of a change to management of their inflation target, bond rates rose in recognition of the potential for higher inflation. This was also evident in commodities with a combination of restricted supply, weaker US$ and inflationary concerns driving demand and prices. These higher commodity prices, and the ongoing healthy state of Australia’s trade accounts, provided further support for the A$.

Domestically, the RBA maintained cash rates at the low of 0.25% and continued to focus on keeping interest rates low for commercial and household borrowers. The RBA is purchasing bonds of around three years duration in the market and providing an increased three-year Term Funding Facility for banks at 0.25%. This serves to ensure that record high government bond issuance does not lead to higher interest rates and that there is sufficient cheap loan supply to corporations, particularly small and medium-sized enterprises. The resulting high levels of liquidity in money markets has also provided support for corporate debt securities, with the credit asset class continuing to deliver positive returns for investors. However, concerns over the impact of imminent changes to government employment support programs on businesses and the unemployed remain.

Outlook and Portfolio Positioning

The ongoing rally on global share markets has continued to defy the higher than normal levels of uncertainty in the economic backdrop. Although the rally has been most concentrated around the technology sector, which is benefiting from an acceleration in structural change, even technology companies ultimately require a healthy and growing corporate sector to create scope for further earnings growth. Hence there is a possibility that equity valuations have now moved beyond that which can be justified by earnings fundamentals. As such, some reorientation of growth portfolios towards less inflated sub-classes, particularly infrastructure, may be warranted.

With the U.S. election approaching in November, it may prove difficult for equity markets to re-test recent highs in the months ahead. The potential for a change in the Presidency of the world’s largest economy may at least temper market sentiment and pause some of the optimistic bidding up of valuations, which has dominated the market direction over recent months. Also adding to the uncertainty in the months ahead, is the unwinding of various stimulus and government support programs around the globe. There is a risk that these programs have masked the true impact of the longer-term earnings damage to selected sectors and companies caused by the COVID crisis and related shutdowns. Adjustments may therefore be required in the market’s assessment of both earnings and credit risk.

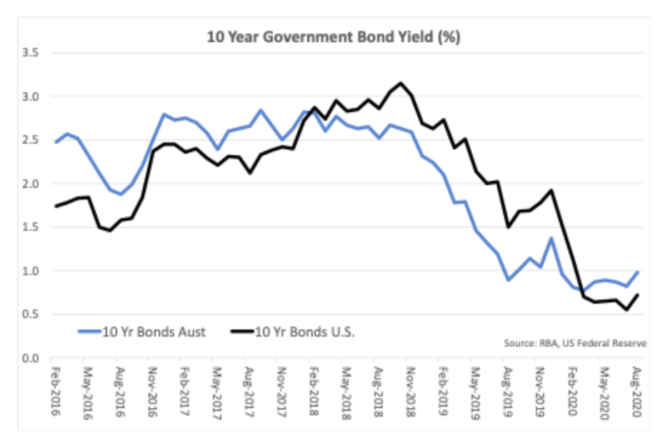

As previously highlighted, exceedingly low interest rates across the yield curve have also presented investors with higher than normal “duration” risk from bonds as yields have provided minimal compensation for the risk of capital loss should interest rates rise. Last month saw some retracement of the recent down trend in yields, and fixed interest indexes produced negative returns as a result. Underpinning the rise in bond yields appears to be an increase in inflationary expectations, with recently announced changes to the approach adopted by the US Federal Reserve likely to result in a greater willingness to allow inflation to rise above the 2% level so that this longer term target is more likely to be achieved on “average” over time. The potential for stimulus induced inflation to run ahead of expectations provides another source of risk for investors. This risk may not only play out in bonds markets but may also challenge at least some of the basis upon which equities have been valued higher over recent years.

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged)