Gary Gleeson

Principal | MFM Group

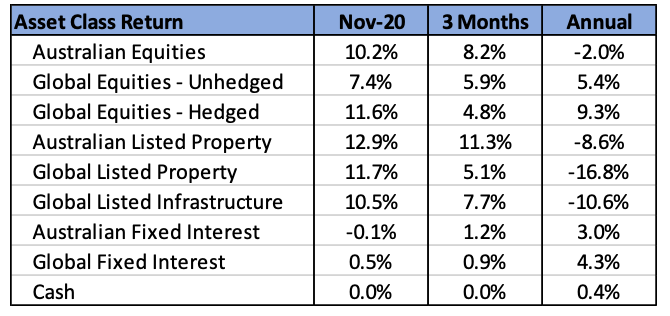

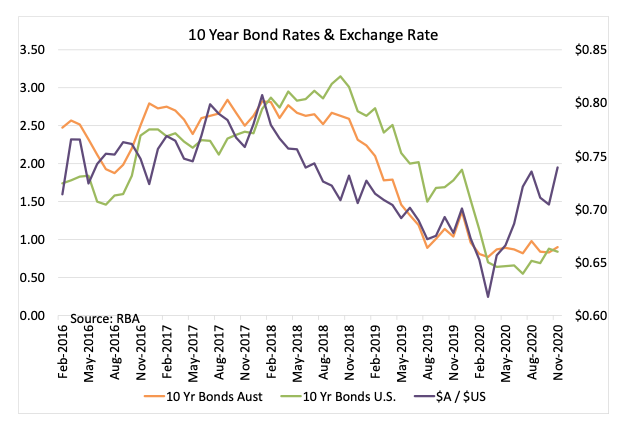

- Global equity markets were extremely strong in November, with the Australian market delivering a record monthly return. Markets rose due to a coincident cluster of positive factors. This included a clear result in the US presidential election (with the likelihood that Democrat control would be tempered by a Republican controlled Senate), continued explicit monetary support from the US Fed, news of successful COVID vaccines and China’s continued economic growth.

- Locally, the easing of the COVID lockdowns in Victoria, supportive State budgets in NSW and Victoria and continued monetary support by the RBA provided an additional source of investor confidence. All up, this may be the largest group of positive impacts the equity market has ever experienced in a single month.

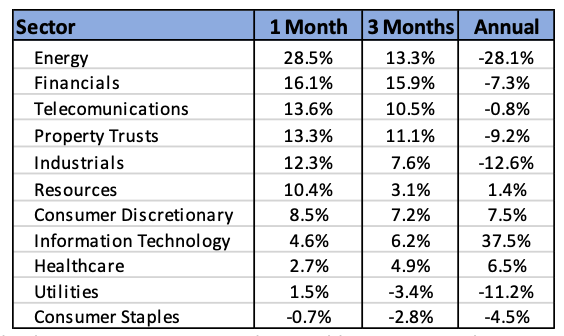

- The A$/US$ rose 5% from $0.7044 to $0.7393, moderating the unhedged global equity return to 7.4%; but leaving hedged global equity returns at 11.6% for the month. Supporting the $A were stronger commodity prices, with iron ore up approximately 10% and oil prices surging 26%. However, coking coal (steelmaking) prices fell again, although the price of thermal (energy production) coal improved 15% after a poor 12 months.

- Despite central banks continuing to emphasise their commitment to low interest rates, there was minimal movement in longer term bond yields, leaving fixed interest returns at low levels.

International Equities

Despite a 6.1% rise, China was the lagging market in November, after outperforming in previous months. In an extraordinary month, most major share markets delivered double digit returns, with the Japanese market surging 15%. Some smaller “Emerging” equity markets were more than 20% higher. The rise was also notably greater in stocks which are more exposed to economic growth rather than the Information Technology sector, which has driven market rallies since March. This change marks a rotation by investors away from “Growth” exposures to “Value” exposures. This rotation is in its early days but may mark a significant change in the drivers of market returns in the months ahead.

Australian Equities

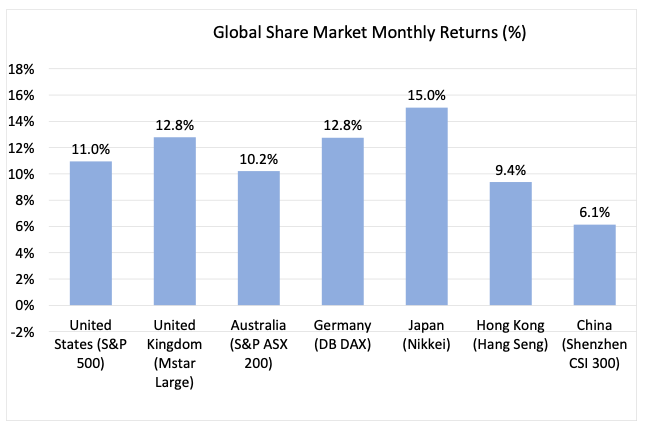

The Australian market rose 10.2% in November, led higher by the energy sector as the prospects of higher growth in 2021 and a rising oil price raised forecast cash flows. Financials, primarily Banks, rose strongly too. Investors viewed bank forecast earnings with more certainty, considering the expected impact of COVID vaccines in the new year and ongoing evidence of housing price growth. The Property sector was also notably stronger, with investors gaining confidence as COVID restrictions were eased. Shopping centre property was particularly strong, as signs of buoyant retail spending continue to build. The long-term impact of increased working from home on office property is not yet clear, however rental outlooks and landlords’ collections have improved. Sectors less exposed to economic growth still delivered good returns – bar Consumer Staples – but were clearly less favoured by investors.

Fixed Interest & Currencies

In early November, the Reserve Bank (RBA) made possibly the last cut in the cash rate target, reducing the rate from 0.25% to 0.10%. Also falling from 0.25% to 0.10% was the target yield on 3-year government bonds. The RBA also lowered the rate on bank settlement balances to zero and implemented a program of government bond purchases with $100bn targeted over the next six months. Importantly, the RBA Governor also indicated his belief that cash interest rates were likely to remain at current levels for at least 3 years. This may be the most significant decision the RBA has ever made to support the Australian economy and has coincided with a record spending expansion by the Commonwealth Government, thereby creating an unprecedented stimulus to the broader economy. Although one of the objectives of the lower interest rate regime is to take upward pressure off the $A (and thereby assist the ongoing competitiveness of Australian exports), the Australian dollar was stronger over November, assisted by higher commodity prices. At US$ 0.7393, the $A posted its highest monthly close since mid-2018.

With the RBA changes largely anticipated by financial markets, there was little movement in bond yields in response to the November monetary policy announcement. The more buoyant outlook for higher economic growth and inflation actually pushed Australian 10-year bond yields slightly higher from 0.83% to 0.90%. As a result, fixed interest returns for Australian investors were slightly negative over the month.

Outlook and Portfolio Positioning

November 2020 appears to have been a watershed month. Although the month may have marked the end of the road in terms of cash rate reductions, the certainty provided by central banks in terms of their commitment to an extended period of loose monetary policy, provided renewed confidence to equity markets. It was also the month when equity markets switched their focus from businesses that would perform well in a lockdown scenario to businesses that would prosper from a cyclical recovery, as vaccine announcements provided visibility of a path to normality. The prospect of a global economic recovery, with sustained low interest rates and the policy “certainty” provided by the US election result all proved too attractive for share market investors to ignore.

Despite the magnitude of the rally on equity markets last month and the general “glass half full” sentiment currently dominating, not all listed assets appear over-valued. If there is a genuine economic recovery across the globe, then some sectors and markets that have lagged considerably over 2020 may still be considered undervalued. Emerging markets, banks and infrastructure standout as potentially having additional valuation runway should the reversion to a more normal economic environment proceed.

However, as is often the case when a euphoric sentiment dominates equity market direction, investors may be giving less consideration to risk than is warranted. First and foremost, the magnitude of economic disruption caused by COVID-19 and the subsequent stimulus programs are of such exceptionality that any forecasts over the pace, timing and magnitude of any economic recovery must be qualified with a high degree of uncertainty. One of the key areas of uncertainty is the degree to which the stimulus will become inflationary. A jump in inflation could threaten the dominant expectation of prevailing low interest rates, which could in turn undermine much of the basis for current equity valuations.

In addition, the US election result hasn’t removed all uncertainty from the boundaries of future US economic policy, with Senate control subject to a run-off election in the State of Georgia in early January.

Despite the risks described above, equity markets may continue to rally. Given the low interest rate regime, equities still provide the most likely source of wealth accumulation for investors in the years ahead. However, the magnitude of the recent price rally and the significance of unknown variables, suggest excessive or overweight positions should be avoided. Biasing exposure to those areas of the equity market appearing cheaper, as noted above, may be one effective strategy of managing risk in the current market.

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged)

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Melbourne Financial Management Group Pty Ltd (ACN 600 540 378), trading as MFM Group, is an authorised representative and credit representative of Hillross Financial Services Limited, Australian Financial Services Licencee and Australian Credit Licensee (232705).

Your privacy is important to us and Hillross Financial Services Limited, which is part of AMP. You may request access to your personal information at any time by calling us on 03 8394 0300 or contacting AMP on 1300 157 173. Information collected will be subject to AMP’s Privacy Policy. You can also contact us or AMP if you do not wish to receive information about product, services or offers available from us or AMP from time to time.