(Gary Gleeson)

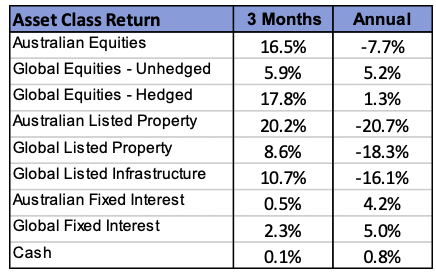

- The June Quarter delivered a strong rebound in equities prices as markets took an optimistic view of the speed of recovery from the global COVID related recession. Central Banks remained supportive, despite some early signs of governments reigning in spending. Low interest rates and continuing money market liquidity support have seen asset prices rise around the world.

- Global equities were an average of 18% higher over the quarter to be marginally above the level recorded one-year ago.

- Fixed interest markets remained flat as interest rates and returns appear likely to remain muted in the short term.

- The $A rose 11.1% from US 62 cents to US 69 cents, assisted by generally stronger than expected commodity prices.

International Equities

Much of the losses experienced in the March quarter were reversed in the June quarter, with the global equity market staging its fastest ever rebound from a serious correction. Unprecedented levels of government and central bank support were major factors in assisting the recovery. The US led the rebound despite a resurgence in COVID cases in June. Returns have been concentrated in the large tech stocks with the tech-heavy NASDAQ index out-performing the broader S&P500. German equities rose 29% as the country re-opened following a relatively successful pandemic strategy. Japan has also performed well with a 17.8% rise in the Nikkei Index last quarter. The Chinese market improved 14.2% as the economy returned to a more normal level of activity earlier than most (which helped sustain iron ore and other commodity prices). Chinese banks and the government have maintained relatively high levels of liquidity and lending activity to support the improvement. Hong Kong has delivered a positive return, despite continued unrest as China imposed stricter laws and removed elements of the Territory’s special status. The UK remains in flux as COVID lockdown levels fluctuate and the Brexit process continues unresolved. Despite this uncertainty, the UK equity market advanced 7.4%.

Australian Equities

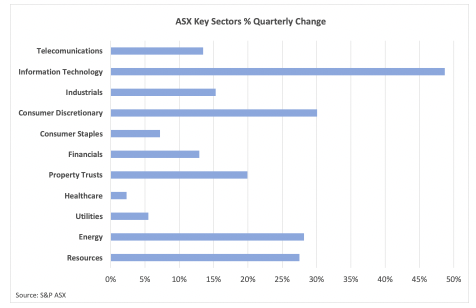

The Australian market was also strong, rising 16.5% overall. There was a wide disparity in returns across sectors, but all were notably positive. Information Technology maintained its number one ranking delivering 49% for the quarter – consistent with returns to the sector in the US market. Healthcare & utilities were the poorest returning groups, as investors moved from defensive sectors to more cyclical and strongly growing companies. In response to the revenue disruption caused by the COVID crisis, companies raised additional capital with more than $24bn in new shares issued. Energy stocks returned 28% as oil prices stabilised at around $US 40 per barrel, markedly improving the outlook for profits. The resources sector was generally supported by improved commodity prices. The outlook for property trusts also brightened as some signs of normalisation in retail spending boosted support for shopping centre properties after a particularly large drawdown in March. Industrial properties also performed well over the quarter, as the COVID crisis was seen to accelerate the trend to on-line ordering and home delivery, thereby creating increased demand for warehouse type properties.

Fixed Interest & Currencies

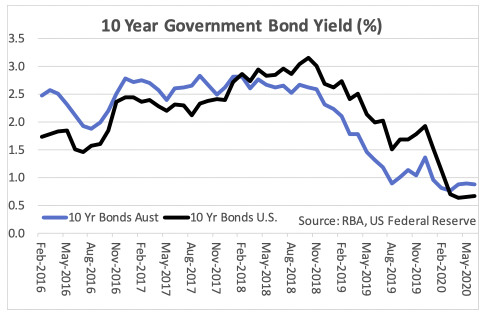

Global and domestic bond yields remained flat over the quarter. The Australian Government 10-year yield finished the quarter marginally higher at 0.9%, with the U.S. equivalent finishing slightly lower at 0.7%. The fact that Australian longer-term bond yields have remained slightly higher than U.S. yields may have added support to the Australian dollar. Also assisted by relatively firm commodity prices, the $A staged a rapid recovery over the June quarter, rising from US 62 cents to US 69 cents.

Although interest rates were flat, fixed interest investors did benefit from improvements on credit markets. Strong levels of buying of corporate debt securities by central banks saw credit valuations recover, despite the uncertainty as to what impact the economic downturn will have on the financial position of individual companies.

With central banks globally maintaining high levels of liquidity, it seems unlikely that short- or medium-term interest rates will rise until we see significant economic recovery. The Governor of the Reserve Bank of Australia (Philip Lowe) suggested in May that “The Board is committed to do what it can to support jobs, incomes and businesses and to make sure that Australia is well placed for the recovery. …… The Board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.” The Governor did have a more optimistic view of the recovery than previously, however high levels of uncertainty surround any economic forecasts. Longer term interest rates have also remained relatively unchanged and until there is the prospect of inflation, there appears to be little impetus for bond yields to rise.

Outlook and Portfolio Positioning

The magnitude and pace of the collapse in equity markets in March and recovery over the past 3 months highlights the unpredictable nature of share prices and the difficultly involved in predicting short term performance. Whereas in March the focus and sentiment of share markets was clearly on the short term impact of the COVID-19 crisis, this focus has quickly reset to the long term with investors prepared to “look-through” the crisis the period and the disturbing recent escalation in infection rates. Also relevant to this long-term focus has been the ongoing rally in selected Information Technology stocks, with the crisis period appearing to bring forward some of the structural changes (e.g. on-line purchasing) that were set to benefit these stocks. Notwithstanding the fundamental merits of the improved prospects for large parts on the Information Technology sector, investors should be increasingly cautious over the current level of equity market valuations given the degree of uncertainty in the economic outlook.

The speed of the recovery in the value of the $A has been rapid over the past 3 months and is reflective of the more positive outlook for global economic growth. However, it remains too early to unwind any currency hedging that was put in place to take advantage of the lower $A. Further upward momentum in the $A is possible, particularly given the recent strength of Australia’s trade accounts and relatively favorable position in relation to the COVID-19 management. However, optimism around the $A (and indeed the Australian equity market) should be tempered somewhat by the increasing trade and political tensions surrounding China, to whom Australia’s economic fortunes remain inextricably linked.

Although the position of equity market investors has significantly improved over the past quarter, returns from defensively orientated cash and fixed interest investments remain near historic lows. With the continuation of exceedingly low interest rates considered to be a necessary policy for the period ahead, there are few silver linings on the horizon for defensive investors. Increasingly, the role of defensive investments in a portfolio has changed from that of steady wealth accumulation to solely being one of wealth protection. For overall portfolio returns to comfortably exceed inflation in the period head, some exposure to the growth investments will be required.

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged)

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Melbourne Financial Management Group Pty Ltd (ACN 600 540 378), trading as MFM Group, is an authorised representative and credit representative of Hillross Financial Services Limited, Australian Financial Services Licencee and Australian Credit Licensee (232705).

Your privacy is important to us and Hillross Financial Services Limited, which is part of AMP. You may request access to your personal information at any time by calling us on 03 8394 0300 or contacting AMP on 1300 157 173. Information collected will be subject to AMP’s Privacy Policy. You can also contact us or AMP if you do not wish to receive information about product, services or offers available from us or AMP from time to time.