(Gary Gleeson)

MFM Group

Hillross

Given the wild and unprecedented daily swings in share market valuations we have witnessed over recent weeks, it is clearly apparent there is not a strong market consensus as to what shares are worth in the midst of the current crisis. Movements in valuations of 5% or more in daily share market indices have become frequent, when previously changes of this magnitude would take months to play out.

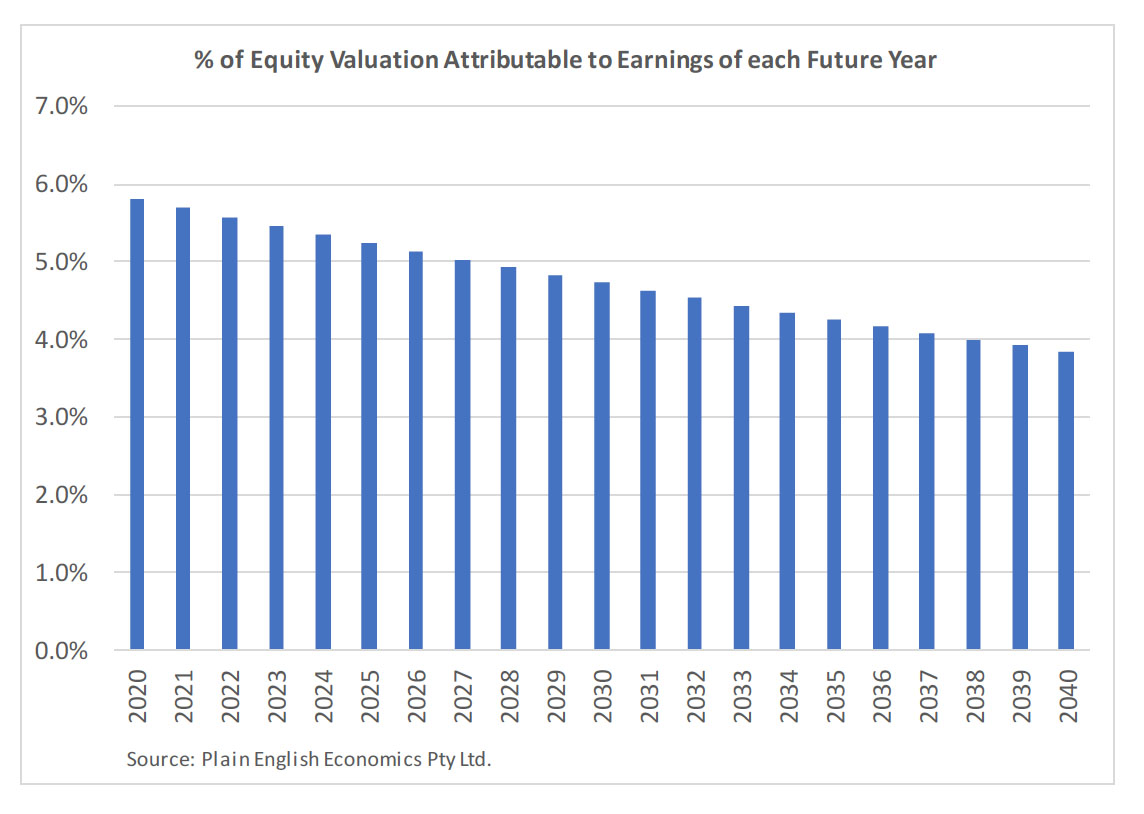

Despite the uncertainty triggered by the spread of the COVID-19 virus, the underlying principles of share market valuation should not have changed. The value of a share represents the sum of the present value of all future earnings that will accrue to that shareholding. As such, earnings expected to be generated next year are relevant to determining the value of a share; but so are earnings in year 2, year 3 and beyond. Earnings in future years should be “discounted” for the time value of money and a “risk premium” to account for the uncertainty as to what earnings in future years will be. In this way, projected earnings of $100 in say year 2030 are worth less in valuation terms than $100 expected to be earned in 2022. In periods of exceedingly low interest rates like we have at present, this “discounting” of future years earnings is less significant than it would normally be.

For convenience, we often measure the valuation of share markets by comparing current prices with next year’s expected earnings. This measurement is known as the price to earnings ratio (or PE ratio). Earlier this year prior to the impact of COVID-19, Australian share markets were trading at a level consistent with a PE ratio of around 17 times. That is, across the broader market, share prices were 17 times the level of annual earnings. Another way to interpret this would be to state that next year’s earnings contributed to only one-seventeenth (roughly 6%) of the value of a share.

There is near universal agreement that the current period of heightened impact from the virus is temporary and normality will ultimately return. The impact on company earnings in the short term will be hugely significant – perhaps the greatest decline ever experienced in such a short period of time. However, if we were to assume that company earnings over the next 12 months were to fall to zero across the broader market and then revert to normal trends, a decline in current share market valuations of 6% could be deemed rational. Perhaps more realistically though, it could be argued that there has been a long-term impact on investor confidence and equity returns need to be higher in future to compensate for the risk of a higher incidence of viruses in the future. This would be expressed via a lowering in the PE from 17 times to say 15 times. This change in PE, together with a loss of first year earnings, implies a reduction in share prices of 19% would be appropriate.1

As at the 30th March 2020, the Australian share market had declined 28% from its late February peak, after being 35% below this peak earlier in March. Whilst there is considerable uncertainty over the ultimate impact of virus containment policies on economic growth and company earnings, the fall in share market valuations does appear excessive if viewed from the context of the expected change in long term company earnings. As past experience suggests, it is typical for equity markets to overshoot in the downward direction in times of heightened uncertainty. There may be various reasons for this, including algorithmic or computer-based trading triggering selling, the liquidity pressures faced by some market participants, as well as an underlying tendency by investors to focus on the short term.

Amid this crisis it may be difficult to have any degree of confidence that there will be a return to normality and therefore the relevance of using longer term earnings as the basis to value shares could be questioned. It is true that some companies will sadly not have a long term and won’t survive this crisis. As such, it is more important than ever to remain diversified as an investor. Much of what we are seeing in recent government policy is aimed at ensuring there will ultimately be normalisation of earnings across the broader market. Additionally, it should be stressed that broad market indexes are heavily weighted towards larger companies, which generally have high levels of financial reserves and a capacity to survive periods of falling revenues. By investing in shares we are ultimately investing in the resiliency, adaptiveness and ingenuity of the human beings working for corporations. This combination of qualities has consistently delivered for shareholders over time and there is no reason to expect why these qualities won’t continue to deliver once this crisis has passed.

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group