(Gary Gleeson)

MFM Group

Markets sink in response to coronavirus spread

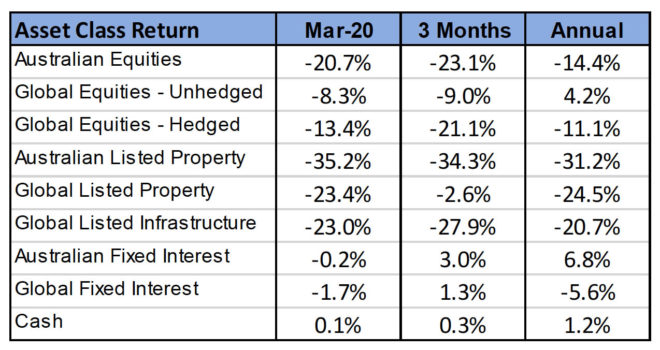

- Market performance across asset classes in March was dominated by the focus on the spread of the COVID-19 and the impact of containment measures put in place to slow its spread.

- • Equity markets continued the decline which commenced on February 20th in Australia. Bond yields fell to new record low levels and North Sea Oil finished the month at $US 25.62 per barrel, down 61%.

- • The domestic equity market ended the month of March down 30% from its high in February and 23% lower than the levels at the end of December.

- • A decline in the $A ( down 11.9% against the $US) helped cushion Australia’s relative economic position and assisted returns to Australian investors with unhedged international assets.

International Equities

After peaking on 20th February, global share markets continued to slide through the first 3 weeks of March as the coronavirus spread outside of China become increasingly evident. A bottom was reached on the 23rd March when the US Congress and Senate reached agreement on the nature of an economic relief package. With the US initially spending two trillion dollars and other major governments reacting similarly, markets partially recovered over the final week of March. In addition to unprecedented government spending programs, stimulatory policies put in place by central banks also assisted, resulting in lower interest rates and additional liquidity in money markets. The liquidity injections were particularly important in unlocking credit markets, which had virtually stopped functioning due to a lack of willing buyers at times in March.

The fall in share market valuations experienced over late February and through March was one of the most rapid ever, with some of the highest volatility. Excluding the impact of currency changes, global equities finished March 13% lower. The U.S. market decline was broadly in line with this average. European markets, however, fell by more than average given the extreme impact of the coronavirus across many European economies. Spanish and Italian share markets were 22% lower over the month. In contrast, share markets in Hong Kong and China were not as weak, reflecting China’s improving outlook as the virus-related restrictions were eased.

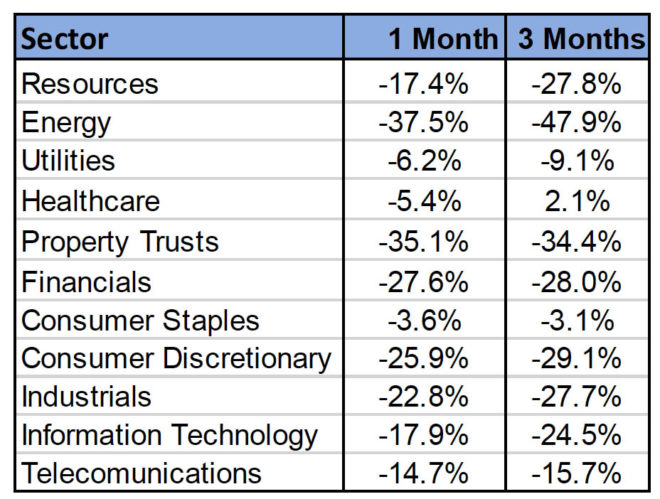

Australian Equities

The Australian market performed well below the global average, with a 21% decline recorded for March. This performance may have been negatively impacted by a withdrawal of offshore portfolio investors as they increased cash positions. The more defensive Consumer Staples, Utilities and Healthcare sectors performed best, while other sectors delivered substantially lower returns. Energy stocks were particularly weak as oil prices moved lower in response to rapidly declining demand and indications from Saudi Arabia and Russia that they would increase the oil supply. Gold and Iron ore prices held up relatively well, leaving producers in these sectors looking at a potential improvement in revenues in $A terms in the short term. Property trusts (down 35%) dropped significantly in value, as investor concern regarding balance sheet structure and the ability of tenants to maintain rental payments (particularly in shopping centres) dominated sentiment.

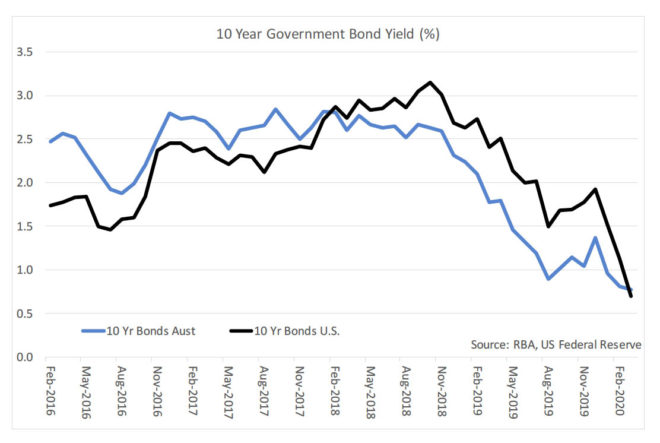

Fixed Interest & Currencies

It was also a highly volatile period on fixed interest and currency markets. Yields on both government bonds and corporate debt securities rose over the first half of March as liquidity dried up. However, central bank activity, both here and abroad, was sufficient to push government bond yields back lower and restore some normality to credit markets. However, yields on corporate bonds still finished the quarter significantly higher, given growing concern over corporate indebtedness. As a result, capital losses were recorded across the spectrum of corporate debt investments, which pushed fixed interest benchmarks into negative territory. This was despite the fact that government bond yields finished the quarter lower and cash interest rates also fell around the globe. In Australia, the Reserve Bank cut the target cash interest rate twice, to the leave the rate at a new record low of 0.25%. Unconventionally, the Reserve Bank also set 0.25% as a target rate for the 3-year government bond yield.

The Australian dollar fell sharply during March, finishing at U.S. 60.9 cents, down from US 65.2 cents at the end of February (and US 70.1 cents at the end of December). The $A did reach a low of 55.5 US cents in mid-March. It has been common for the $A to decline in periods when the global growth outlook deteriorates, as the $A is seen to be more sensitive to global growth cycles given Australia’s reliance on commodity and energy related exports. This tendency for the $A to fall in periods of declining growth, once again helped cushion the impact of falling share prices on Australian investors with unhedged global equity investments. Unedged global share investments averaged a decline of 8% for the month, significantly below the hedged global share average return of 13%.

Outlook and Portfolio Positioning

Uncertainty over the duration and severity of the economic impact of the COVID-19 containment measures is likely to continue to dominate market sentiment until the news flow in relation to the virus improves. This change in sentiment may happen gradually as conditions slowly improve; or it could be sudden as a result of a break-through treatment. Whilst uncertainty currently dominates market sentiment, there remains one certainty. That is, the crisis will end and normality will return to the functioning of the global economy. Investors should be reminded that the majority of the value of a share is determined not by the cashflow received in the year ahead, but by the sum of the cashflows received in years 2,3 and beyond. If the impact of this crisis is primarily restricted to just one year, then it is possible that the fall in equity markets just experienced has been an overreaction. In addition, investors holding well diversified mainstream products tracking broader market benchmarks (such as the S&P ASX 200), can take some comfort from the fact these benchmarks are dominated by their allocations to the largest companies, which in general are best positioned to survive this period and return to toward normalised trading once the crisis ends.

Share markets have a history of overshooting or overreacting in the downward direction in periods of uncertainty and panic. This will often result in significant opportunities for investors who are prepared to stick with their long-term strategies and maintain asset class exposures. Given the level of disruption in financial markets, it may be appropriate to make some tactical shifts, without deviating too far from longer term strategies. For example, the sharp fall in the $A over recent weeks could justify a switch in a portion of an investor’s global equity allocation from being unhedged to hedged in terms of currency exposure. Such a change would help protect against capital losses should the $A revert back to its longer-term average level. In addition, the significant fall in the value of global infrastructure assets may create an opportunity to purchase what are normally considered lower risk asset backed investments at an attractive valuation.

As the saying goes, the darkest hour is often the one before dawn. The most difficult period for investors to maintain commitment to their strategies is often at the depth of a crisis just before the market turns upwards. The cause of this crisis, its speed and the incredible day to day volatility has made it appear like no other. However, unlike the catalysts for market crashes in past periods, this crisis at least has a definable end point, with an unprecedented level of government spending aiming to create a bridge to this end that avoids longer term economic and business destruction.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group