(Gary Gleeson)

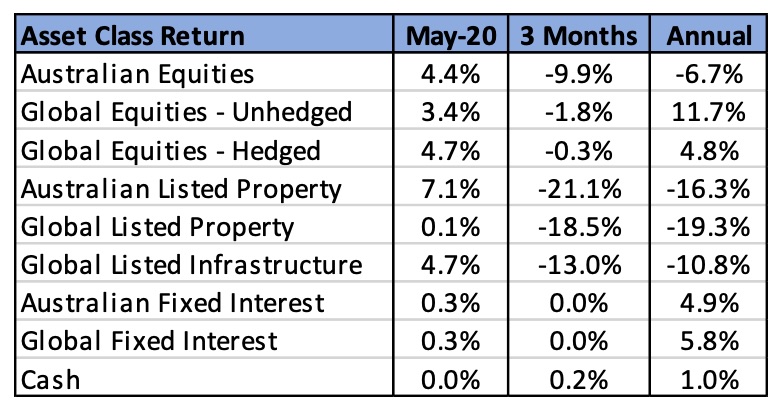

- Asset class performance in May remained positive with a similar distribution of returns to April.

- Global equity markets were stronger (except in China) with the MSCI World Index rising 4.7%.

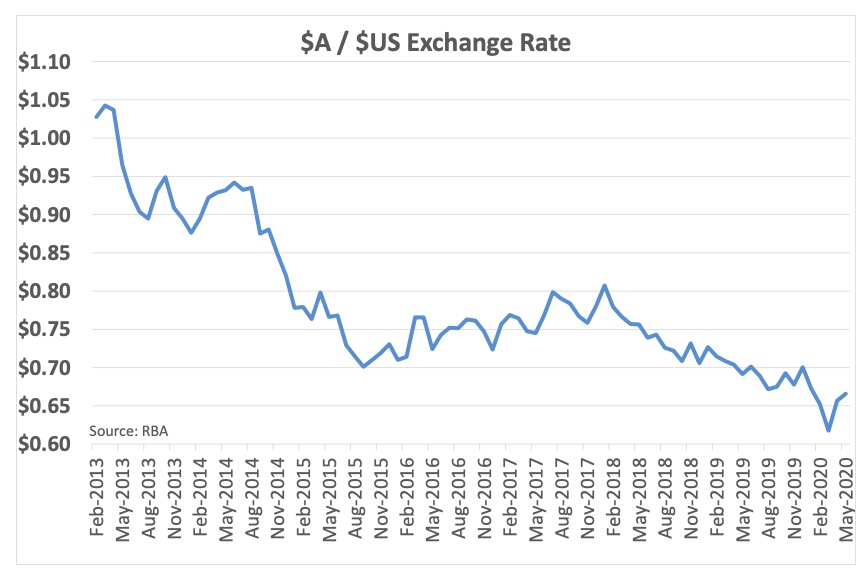

- The $A continued to rally, reaching $0.67, as Australia’s pandemic risk receded, with falling case numbers.

International Equities

International share markets were again dominated by positive sentiment underpinned by progress in coping with the COVID pandemic. In most developed markets the rate of new cases was in decline. This continued improvement helped reinforce last months’ market gains and allowed further optimism around economic recovery. Germany and Japan were particularly strong, reflecting similar success in reducing infection rates, together with a faster restart of economic activity than their peers. In contrast, Chinese markets were weak as unrest around China’s legislative and political changes in Hong Kong caused further market falls there. China also backed away from GDP growth targeting in the face of likely declines in economic activity in the short term. However, activity levels in China do continue to recover despite the challenges. However, it seems unlikely that Hong Kong will be as resurgent in the face of political uncertainty.

Australian Equities

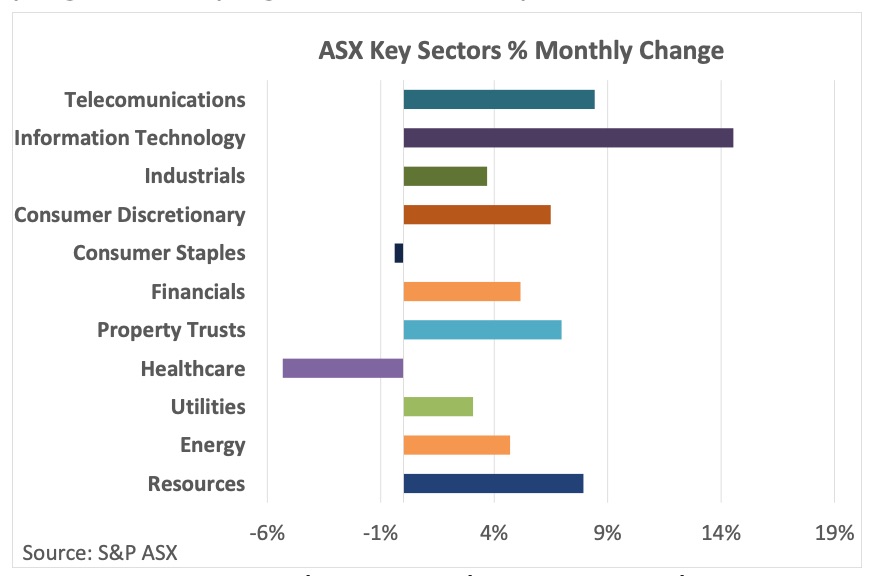

The Australian market again performed well, rising +4.4% overall. Information Technology maintained a strong performance rising +14.5% this month. The sector is more insulated from current economic issues due to exposure to global markets and fewer physical constraints on operations. An additional boost in the month came from an investment in Afterpay (APT, +52%) by Chinese IT conglomerate Tencent. APT is the leader in the “buy now pay later” retail finance sector. Smaller companies (Small Ordinaries Index +10.6%) overall did better than larger companies as share prices continue to benefit from optimism around economic recovery, low interest rates and fiscal stimulus. The Communications and Materials sectors both returned more than 8% as real estate activity and strong Iron Ore and Oil prices helped improve the outlook for revenues. Lagging sectors this month were those which have been safer havens through this crisis. Health Care (-5.3%) and Consumer Staples (-0.4%) were weaker with CSL and ResMed dragging down Healthcare’s performance. Healthcare, Information Technology and Consumer Staples are the three best performing sectors over one year, but investors are now comfortable to look elsewhere for opportunities.

Companies have continued to raise capital as the market has recovered. Many large and small companies have decided that their balance sheets need strengthening and this process continued in May. Most new issues have delivered profits to investors as the market strengthened through the month. None-the-less, the outlook for company profits does remain uncertain with very few management teams willing to give earnings guidance.

Fixed Interest, Currencies & Commodities

Global and domestic bond markets remained flat last month, with fixed interest asset class returns only marginally above zero at +0.3%.

With central banks globally maintaining high levels of liquidity, it seems unlikely that short- or medium-term interest rates will rise until we see significant economic recovery. The Governor of the Reserve Bank of Australia (Philip Lowe) this week said; “The Board is committed to do what it can to support jobs, incomes and businesses and to make sure that Australia is well placed for the recovery. …… The Board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.” The Governor did have a more optimistic view of the recovery than previously, however high levels of uncertainty surround any economic forecasts. Longer term interest rates have also remained relatively unchanged and until there is the prospect of inflation, there appears to be little impetus for bond yields to rise.

The Australian currency has continued to rebound strongly (now US 66.7 cents), which has been coincident with the falling COVID case numbers and gains in Iron Ore and Oil prices. Although the volume of Iron Ore bought by China has fallen, Brazilian supplier Vale – one of the big three suppliers to Chinese markets – has been constrained by the pandemic and various environmental and social issues. This is benefiting Australian producers and supporting the global iron ore price. Oil prices have recovered significantly following Saudi Arabia’s resolution to reduce supply.

Outlook and Portfolio Positioning

Whereas the recovery in equity markets in the month of April appeared to return share prices to a reasonable fair value, the continued gains in May have pushed prices into a less attractive zone. Sentiment across equity markets has become somewhat euphoric and valuations are approaching the expensive range – given to the elevated geopolitical risks and uncertainty surrounding company earnings. It should be acknowledged that the global economy just experienced the most significant production disruption since World War II and the path to normalised earnings remains uncertain. Because current company earnings are disconnected from both past and future earnings, normal valuation tools are somewhat redundant. This absence of solid valuation metrics increases the possibility of overreaction to partial data and may create much higher than normal volatility. As such, opportunities to increase equity allocations at lower prices may emerge in the months ahead.

Also characterising financial markets over the past 2 months has been an increasing disconnect between bond and equity markets. Normally, increased optimism over the economic outlook would be associated with both rising share prices and rising bond yields. However, bond yields have been largely anchored in the sub 1% range. This is perhaps reflective of the very public commitments central banks have made around maintaining accommodative policy and exceedingly low cash rates for as long as is necessary. The scenario of a strong economic rebound without any upward pressure on longer term bond yields does imply the continued absence of inflation. Given the shock to supply, and the unprecedented monetary and fiscal stimulus over recent months, the continued absence of inflation in the months ahead cannot be considered a certainty. Hence, there is a risk that the failure of bond yields to rise materially over recent weeks creates potential for future capital loss from bonds should bond markets adopt the improved economic growth-based scenario.

The speed of the recovery in the value of the $A has been rapid over the past 2 months and is reflective of the more positive outlook for global economic growth. However, it remains too early to unwind any currency hedging that was put in place to take advantage of the lower $A. Further upward momentum in the $A is possible, particularly given the recent strength of Australia’s trade accounts and relatively favourable position in relation to the COVID-19 management. However, optimism around the $A (and indeed the Australian equity market) should be tempered somewhat by the increasing trade and political tensions surrounding China, to whom Australia’s economic fortunes remain inextricably linked.

Yours faithfully,

Gary Gleeson

BBus(Ec&Fin), MAppFin, CFP®, SSATM

Principal | MFM Group

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged)

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Melbourne Financial Management Group Pty Ltd (ACN 600 540 378), trading as MFM Group, is an authorised representative and credit representative of Hillross Financial Services Limited, Australian Financial Services Licencee and Australian Credit Licensee (232705).

Your privacy is important to us and Hillross Financial Services Limited, which is part of AMP. You may request access to your personal information at any time by calling us on 03 8394 0300 or contacting AMP on 1300 157 173. Information collected will be subject to AMP’s Privacy Policy. You can also contact us or AMP if you do not wish to receive information about product, services or offers available from us or AMP from time to time.